Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

I’ve written many times about Amex Offers and how much money you can save by redeeming them. Amex offers are one of my favorite things about holding multiple American Express cards. I have saved thousands of dollars on clothing, dining, hotels, airfare, and more. These can be found on any American Express card simply by navigating to the offers section on the site or app.

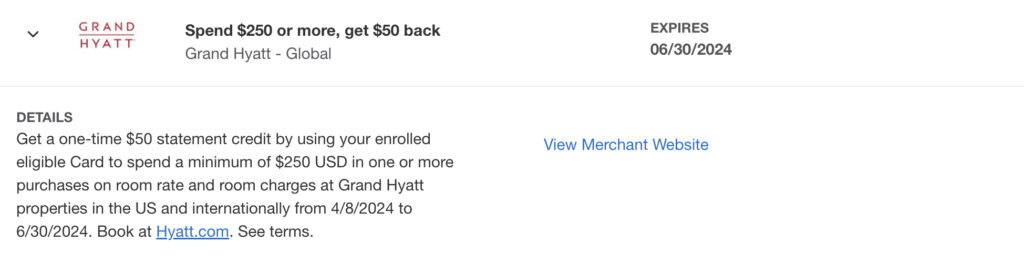

I don’t normally use The Platinum® Card from American Express for hotel stays (other than those booked in the Fine Hotels & Resorts program), but this offer popped up and I know I’ll have a stay at a Grand Hyatt during this period.

Spend $500, Get $100 Back

This is equivalent to a 20% rebate. Get a one-time $50 statement credit by using your enrolled eligible Card to spend a minimum of $250 USD in one or more purchases on room rate and room charges at Grand Hyatt properties in the US and internationally from 4/8/2024 to 6/30/2024. Book at Hyatt.com. See terms.

Terms & Conditions:

- Enrollment limited.

- Must first add offer to Card and then use same Card to redeem.

- Only U.S.-issued American Express® Cards are eligible.

- Limit 1 enrolled Card per Card Member across all American Express offer channels.

- Your enrollment of an eligible American Express Card for this offer extends only to that Card.

- Offer valid at all Grand Hyatt locations in the US and internationally.

- Reservations must be made directly with Hyatt via Hyatt.com, the World of Hyatt mobile app, a Grand Hyatt hotel, or a Hyatt call center.

- Excludes all other Hyatt brand properties.

- Offer not valid for purchases of gift cards or World of Hyatt points.

- Qualifying purchase means a purchase at a participating Grand Hyatt property made during the offer period with your enrolled American Express Card and which is in an amount totaling at least $250 USD as posted to your account, following conversion from a foreign currency, if applicable, in accordance with your Cardmember Agreement.

- Offer only valid on room rate and room charges.

- Offer not valid for lodging stays that are paid for before the promotion start date or after the promotion end date.

- Offer is non-transferable.

- Limit of 1 statement credit per Card Member.

- You may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying for the offer. For example, you may not receive the statement credit if (a) the merchant uses a third-party to sell their products or services; or (b) the merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or (c) you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

- Purchases may fall outside of the offer period in some cases due to a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction (for example, the purchase date for online orders may be the shipping date).

- Statement credit will appear on your billing statement within 90 days after 6/30/2024, provided that American Express receives information from the merchant about your qualifying purchase.

- Note that American Express may not receive information about your qualifying purchase from merchant until all items/services from your qualifying purchase have been provided by merchant.

- Statement credit may be reversed if qualifying purchase is cancelled.

- If American Express does not receive information that identifies your purchase as qualifying for the offer, you will not receive the statement credit.

- Limit 1 enrolled Card per American Express Card online account.

- The enrolled Card account must be active, not past due, canceled, or have a returned payment outstanding to receive the statement credit.

- Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied.

- Amex Offers are available for varying and limited periods of time and are dynamic and personalized.

- If you navigate away from the Amex Offers page, you may see different offers when you return.

- For questions regarding your Card Account, please call the number on the back of your Card.

- By adding an offer to a Card, you agree that American Express may send you communications about the offer.

Anthony’s Take: I am planning on staying at a Grand Hyatt in the next few months and adding this to the card is a no-brainer.

Anthony’s Credit Card Pick: I love many of the benefits of the The Platinum Card® from American Express. I particularly like that it grants me access to many lounges. It has had a prominent place in my wallet for many years now. While it does have an annual fee of $695, it provides many travel benefits and will always be my go-to for lounge access (both Delta Sky Clubs® and Centurion Lounges) and booking airfare from the airlines to earn 5x points (up to $500,000 per calendar year). Learn more. Rates & Fees. Terms apply.

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.