Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

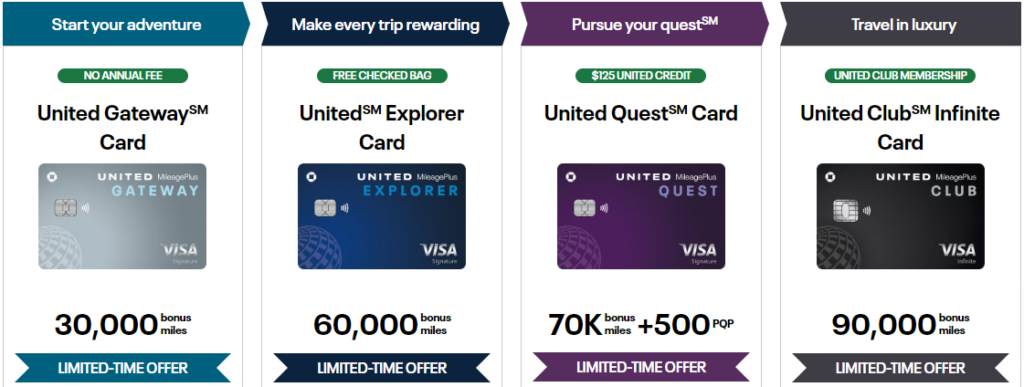

United Airlines used to be my primary airline and with it I picked up both the United Explorer℠ Card and the United Quest℠ Card and have used these cards to earn tons of United MileagePlus miles through the years. Both of these cards as well as the two other co-branded offerings from Chase and United have limited-time increased welcome bonuses at the moment. Here is a look at what each offers and why it might be a good time to pick one of these cards up.

United Gateway℠ Card

This is the entry-level United card with no annual fee. It offers the following benefits:

- 2 miles per $1 spent on United Airlines, gas stations, and local transit/commuting

- 1 mile per $1 spent on anything else

- A 25% statement credit on purchases made onboard (think Wi-Fi or snacks)

- No foreign transaction fees

- Trip cancellation/interruption insurance

It currently has a limited-time offer where you can earn 30,000 bonus miles after you spend $1,000 on purchases in the first three months your account is open. Plus, it’s offering a 0% intro APR for 12 months from account opening on purchases.

United℠ Explorer Card

This is the best card for regular United flyers and one of the two United cards I hold. The annual fee is waived the first year, then $95 and it offers:

- 2 miles per $1 spent on United Airlines, restaurants, hotels (booked directly through the hotel)

- 1 mile per $1 spent on anything else

- Upgrades on award tickets for Premier® members (a benefit not offered to anyone else other than GS members)

- A free checked bag on every flight

- A 25% statement credit on purchases made onboard (think Wi-Fi or snacks)

- A Global Entry, TSA PreCheck,® or NEXUS fee credit — up to $100

- No foreign transaction fees

- Two United Club℠ passes (annually)

- Priority boarding with Group 2

It currently has a limited-time offer where you can earn 60,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open.

This is the best card for frequent United flyers and the other United card I hold. Its annual fee is $250 and it offers:

- 3 miles per $1 spent on United Airlines

- 2 miles per $1 spent on all other travel, restaurants, and select streaming services

- 1 mile per $1 spent on anything else

- $125 annual United purchase credit

- Up to two 5,000-mile anniversary award flight credits

- Free first and second checked bags on every flight

- A 25% statement credit on purchases made onboard (think Wi-Fi or snacks)

- A Global Entry, TSA PreCheck,® or NEXUS fee credit — up to $100

- No foreign transaction fees

- Priority boarding with Group 2

It currently has a limited-time offer where you can earn 70,000 bonus miles and 500 Premier qualifying points after you spend $4,000 on purchases in the first three months your account is open.

This is the best card for heavy United flyers who want access to the United Club℠. Its annual fee is $525 and it offers:

- 4 miles per $1 spent on United Airlines

- 2 miles per $1 spent on all other travel and restaurants

- 1 mile per $1 spent on anything else

- A United Club℠ membership

- Premier access® travel services

- Upgrades on award tickets for Premier® members (a benefit not offered to anyone else other than GS members)

- The ability to earn up to 10,000 Premier qualifying points (PQP) each year; 25 PQP for every $500 you spend on qualifying purchases

- Free first and second checked bags on every flight

- A 25% statement credit on purchases made onboard (think Wi-Fi or snacks)

- A Global Entry, TSA PreCheck,® or NEXUS fee credit — up to $100

- No foreign transaction fees

- Priority boarding with Group 2

Anthony’s Take: If you are a United flyer, having one of its cards makes sense. These welcome offers are a good way to rack up some miles towards your next trip.

(Featured Image Credit: Chase.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.