Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

I’ve written many times about what a great program Amex Offers is and how much money you can save by redeeming them. Amex offers are one of my favorite things about holding multiple American Express cards. I have saved thousands of dollars on clothing, dining, hotels, airfare, and more. These can be found on any American Express card simply by navigating to the offers section on the site or app.

I have used several in the past when booking airfare on various airlines. A new offer just popped up and I was targeted for it on The Platinum Card® from American Express. This is the perfect card for this to hit as I’ll earn 5x points per $1 spent up to $500,000 on airfare per calendar year. It will appear on your statement as a credit.

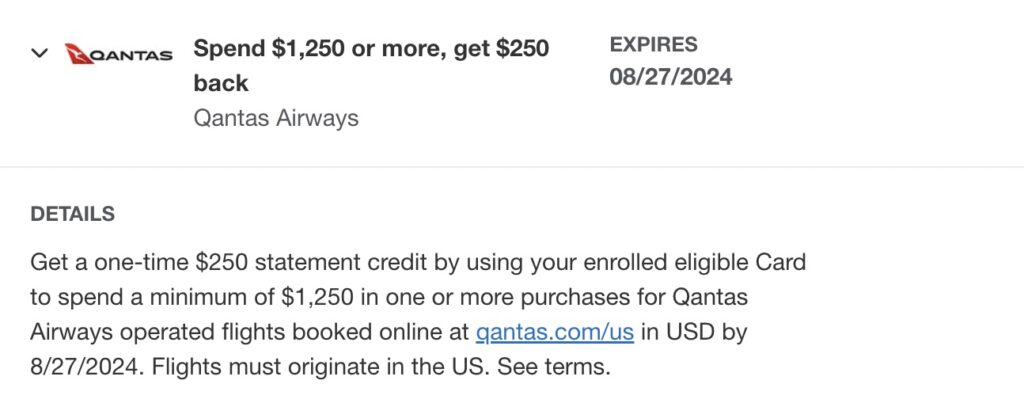

Spend $1,250, Get $250 Back

Get a one-time $250 statement credit by using your enrolled eligible card to spend a minimum of $1,250 in one or more purchases for Qantas Airways operated flights booked online at qantas.com/us in USD by 8/27/2024. Flights must originate in the US.

Terms & Conditions:

- Enrollment limited.

- Must first add offer to Card and then use same Card to redeem.

- Only U.S.-issued American Express® Cards are eligible.

- Limit 1 enrolled Card per Card Member across all American Express offer channels.

- Your enrollment of an eligible American Express Card for this offer extends only to that Card.

- Offer valid for purchases made directly with Qantas Airways only at US website qantas.com/us or through the US mobile app.

- Flights must originate in the US. Purchases such as additional baggage and seat selection fees are included if purchased with initial booking and appears on the same receipt as the flight.

- Not valid for purchases by phone, at terminals, lounges, or on-board flights.

- Excludes (i) all purchases with third parties, affiliates, partners, (ii) travel insurance, car rentals, hotels, airport transfers, tours, activities, (iii) gift vouchers, vacation purchases, merchandise, (iv) Bid Now Upgrades, The Qantas Club membership & lounge access fees, and purchases made via the Points Plus Pay program.

- Offer is non-transferable.

- Valid only on purchases made in US dollars.

- Limit of 1 statement credit per Card Member.

- You may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying for the offer.

- For example, you may not receive the statement credit if (a) the merchant uses a third-party to sell their products or services; or (b) the merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or (c) you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

- Purchases may fall outside of the offer period in some cases due to a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction (for example, the purchase date for online orders may be the shipping date).

- Statement credit will appear on your billing statement within 90 days after 8/27/2024, provided that American Express receives information from the merchant about your qualifying purchase.

- Note that American Express may not receive information about your qualifying purchase from merchant until all items/services from your qualifying purchase have been provided by merchant.

- If American Express does not receive information that identifies your purchase as qualifying for the offer, you will not receive the statement credit.

- Limit 1 enrolled Card per American Express Card online account.

- The enrolled Card account must be active, not past due, canceled, or have a returned payment outstanding to receive the statement credit.

- Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied.

- Amex Offers are available for varying and limited periods of time and are dynamic and personalized.

- If you navigate away from the Amex Offers page, you may see different offers when you return.

- For questions regarding your Card Account, please call the number on the back of your Card.

- By adding an offer to a Card, you agree that American Express may send you communications about the offer.

Anthony’s Take: Always check your account for new offers. If you have plans to fly Qantas and are targeted, add this one before booking.

(Featured Image Credit: Fidel Fernando.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.