Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

I’ve been open in the past that I’m not a huge fan of American Airlines. Back in May I wrote about an experience that cemented my view, even though my home airport in Chicago is a hub (more here). American had its earnings call today and the thing that struck me as most interesting is that the carrier was not profitable from actual flying, but they made money selling miles to banks.

This is nothing new. The Atlantic wrote an article in September. It discusses how Congress brought about deregulation with the abolishment of the Civil Aeronautics Board (CAB). It used to determine what routes airlines could fly and how much they could charge passengers. Airlines were treated like utilities. American developed AAdvantage, its frequent-flier program, in 1981 to incent business travelers to choose them since they were paying more than the last-minute, bargain fares that the airline offered to fill its planes.

American Airlines was one of the first airlines to partner with a bank (Citibank) to issue a co-branded credit card. That was 37 years ago in 1987. It offered the ability to earn miles from everyday purchases that could then be redeemed for free flights. This was the beginning of how we got to where we are today. Frequent flier programs began to become more profitable then providing transportation. Miles could be created and then sold to banks for real money. American Express gives Delta billions of dollars to purchase miles that in then uses to drive usage of its suite of co-branded cards. Chase partners with United and Southwest. Alaska Airlines works with Bank of America. They all have the same premise and pitch to consumers. Use our card to earn that free vacation faster. The banks make money off of the swipe and other fees.

This has become incredibly lucrative to airlines. Last year, Fast Company reported on how consumers charged almost 1% of the US GDP to Delta’s American Express co-branded credit cards. That’s a sum that cannot be ignored. Airlines and banks are in bed together and that won’t be changing. Some of the changes that Delta initially rolled out to its frequent flier program were quickly retracted as cardholders began ditching their cards that once granted them unlimited access to Delta’s Sky Clubs® (more here). I’m sure American Express was none too pleased when its phones lit up with angry customers.

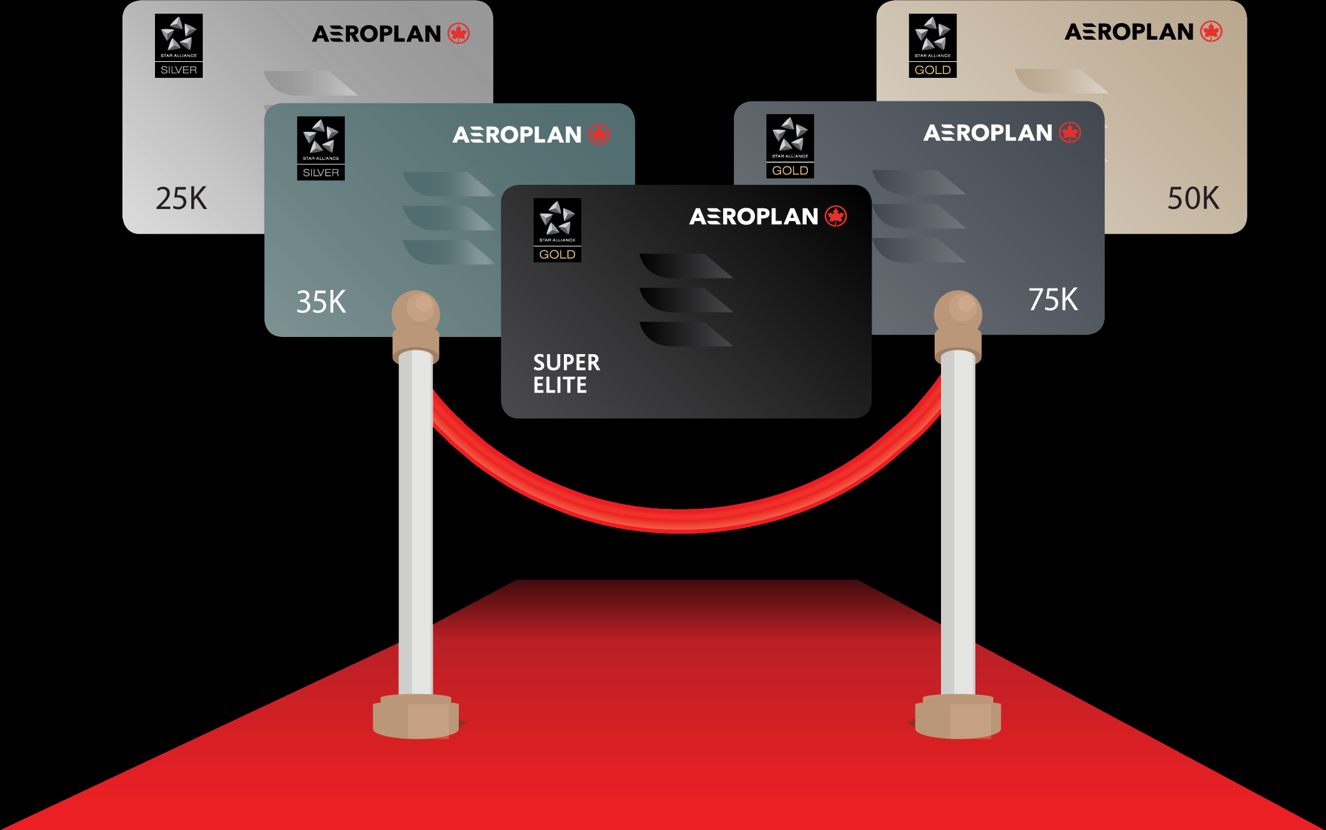

Frequent flier programs are incredibly valuable assets of the airlines. Air Canada spun off its Aeroplan program and sold it in 2002. It then bought it back for $450 million CAD in 2018 to relaunch it in 2020. The program has around five million members. US airlines have considerably more based on their scale.

Consumers have gotten hooked on earning perks from credit cards. Whether that’s cash back, points, or gift cards. The model is a bit broken, but everyone gets their little kickbacks and it keeps marching on.

Anthony’s Take: This will continue as long as there are frequent flier programs. We’re too far down the rabbit hole at this point. It just makes me wonder when airlines will stop flying and just become mile brokers to banks.

(Image Credits: American Express, American Airlines, Citi, Aeroplan.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.