Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Major US airlines increasingly rely on loyalty programs and co-branded credit cards as major profit engines. United Airlines is now making that reality impossible to ignore. While the biggest carriers already generate billions annually through these partnerships, they continue to push for even more growth by tying travel perks directly to credit card ownership.

United has just announced sweeping changes to its MileagePlus program and the message is clear: travelers with a United co-branded credit card will come out ahead, while those without one will see fewer benefits. The new updates reshape how passengers earn miles, redeem awards, and access discounted travel. They place holding a United credit card at the center of the entire loyalty ecosystem.

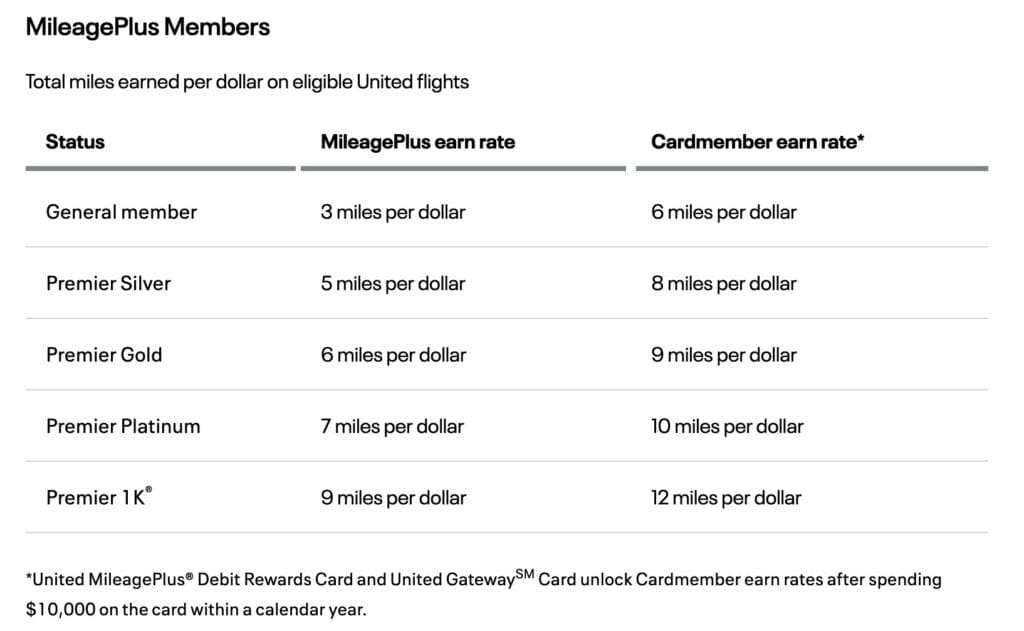

For flights purchased on or after April 2nd, United will change how MileagePlus members earn miles. Miles will still be based on ticket cost, but earning rates will now depend not only on elite status, but also on whether the traveler holds a United MileagePlus credit card. Historically, elite status determined how many miles members earned per $1 spent, regardless of credit card ownership. That structure is ending.

Under the new model, primary cardholders will earn significantly more miles on standard United tickets than non-cardholders. Members will earn even more miles when paying with an eligible United credit card, creating a two-tier system where cardholders are rewarded far more aggressively.

For example, a Premier 1K® member with a UnitedSM Club card could earn up to 17 miles per $1 spent, which is among the highest earning rates in the airline loyalty space. This rate drops depending on card type with Premier 1K® members with United GatewaySM Cards earning up to 14 miles per $1 spent, United ExplorerSM Cards earning up to 15 miles per $1 spent, and United QuestSM Cards earning up to 16 miles per $1 spent. Even general members without elite status will see major mileage boosts if they hold a card (earning multiple times what a non-cardholder would receive).

One of the most restrictive changes involves Basic Economy fares. Starting April 2nd, non-elite MileagePlus members will no longer earn miles on Basic Economy tickets unless they hold a United co-branded credit card. That means travelers flying United’s cheapest fares without status or a card will earn nothing at all. This marks a significant shift in how United treats entry-level customers.

On the redemption side, United is introducing broad discounts on award flights for credit card members (similar to what Delta has offered for some time). Cardholders will save at least 10% on every United award flight they book. Premier elite members who also hold a United credit card will receive at least 15% off. These discounted prices will be displayed directly in the United app and on the website for primary cardholders. United also plans to show the discounted rates to all customers, which effectively makes award pricing a marketing tool to encourage new credit card sign-ups.

For example:

- A 15,000-mile Economy Class award could drop to 13,500 miles for cardholders

- A 200,000-mile Polaris® (Business Class) award could fall to 170,000 miles for Premier cardholders

United is also expanding special Saver Award inventory in United Polaris® for cardholders. Previously, much of the lowest-priced Polaris award space was reserved for top-tier elites. Now, general MileagePlus members with a United credit or debit card will gain access to Polaris Saver Awards that were once far more limited. This is a noticeable ding for Premier 1K® members.

With the new discount stacking on top, Polaris® awards that normally cost 80,000 miles could be reduced to:

- 72,000 miles for general cardholders

- 68,000 miles for Premier cardholders

United says these Saver Awards already offer substantial value and the new combination of expanded inventory and discounts will allow cardholders to consistently redeem for fewer miles.

While United has offered cardholder perks for years, the scale of this overhaul represents a major shift. The airline is now directly awarding miles differently based on credit card ownership (a move that goes further than most competitors have implemented). On the redemption side, the program is continuing trends already underway, such as restricted premium award availability and special discounts for cardholders. But the new earning structure makes the divide between cardholders and non-cardholders more dramatic than ever.

Anthony’s Take: United MileagePlus is evolving into a loyalty program where holding a co-branded credit card is no longer just a bonus, but increasingly a requirement to earn miles efficiently, access discounts, and unlock premium award space. I am not against the changes, overall. But, I think Premier 1K® members need something additional to make up for award space being provided to a much larger pool of travelers.

(Image Credits: United Airlines.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

1 comment

Great for US-based MP members who can simply get Chase-issued cards. Not so great for non-US MP members. UA is basically getting owned by Chase.