Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

As mentioned on the About page, I currently carry 16 cards in my wallet. They all have specific uses, but some get more love than others. One of my favorite cards for the past several years has been The Platinum Card® from American Express. Here are five reasons why I continue to carry this card and the great value I see from it.

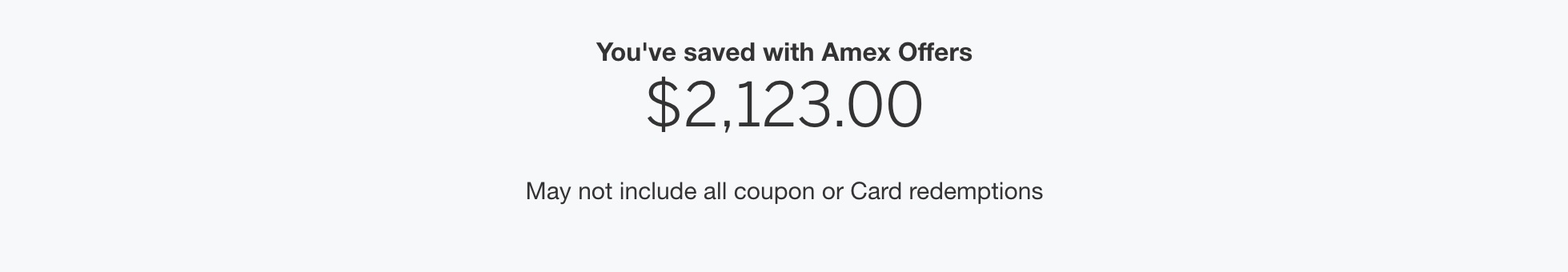

5. Amex Offers

Amex Offers are essentially statement credits that post for qualifying purchases. I have saved hundreds of dollars at hotels, on shopping for clothes, and even at the gas station by adding these offers to my card. I have multiple American Express cards, but I find many times that The Platinum Card® from American Express has some of the best available and I have saved over $2,000 by applying these offers. Enrollment is required for select benefits.

4. Up to $200 Fine Hotels + Resorts® Credit

If you want to feel like an elite guest at hotels that don’t normally offer additional benefits or have a loyalty program, check out Fine Hotels + Resorts®. Booking through this program gets you complimentary breakfast for two, an on-property credit, early check-in and late-checkout (based on availability), and the possibility of a room upgrade. I’ve booked these rates in Las Vegas at the Bellagio, at Four Seasons hotels, and even at hotels where I would be entitled to benefits as an elite member (think Marriott or Hyatt properties). When booking one of these hotels through Fine Hotels + Resorts®, I get the benefits listed above in addition to those that my status would grant me. Plus, I’ll earn points and night credits as if I had booked directly with one of these loyalty programs through Hyatt.com or Marriott.com, for example. Best of all, I get up to $200 back in statement credits each year on prepaid stays.

3. 5X Membership Rewards® Points for Flights Booked with the Airlines

The Platinum Card® from American Express is the only card I use when booking airfare from the airlines directly. I don’t use travel booking sites like Expedia or Travelocity, so I find great value in booking on United.com or Delta.com. Points add up quickly when you’re earning five per dollar spent (up to $500,000 per calendar year).

2. Uber Cash

With The Platinum Card® from American Express, I get up to $200 each year in statement credits from taking Uber rides or ordering food delivered through Uber Eats. Enrollment is required for select benefits.

1. Centurion Lounge and Delta Sky Club® Access

I travel a lot and have been a huge fan of the Centurion Lounges for years with some of my favorites being in Las Vegas, LaGuardia, and San Francisco. When I fly Delta, I benefit from being able to enter the Sky Clubs® along the way. I always have a meal and I value each visit around $40-$50 (based on what I would spend if I were having a sit-down meal in the airport). This adds up quickly and gives me quiet places to work, dine, and relax.

Anthony’s Take: I find great value in The Platinum Card® from American Express. It has had a prominent place in my wallet for many years now. While it does have an annual fee of $695, I find the great benefits listed above, plus many others more than cover this cost. It will always be my go-to for lounge access, savings, and booking airfare from the airlines to earn 5x points.

Anthony’s Credit Card Pick: I love the lounges where The Platinum Card® from American Express grants me access. It has had a prominent place in my wallet for many years now. While it does have an annual fee of $695, it provides many travel benefits and will always be my go-to for lounge access (both Delta Sky Clubs® and Centurion® Lounges) and booking airfare from the airlines to earn 5x points (up to $500,000 per calendar year booked directly with passenger airlines or through American Express Travel). Learn more. Rates & Fees. Terms apply.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

(Image Credit: American Express.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

2 comments

Bulkhead

I have been a AMEX cardholder for 30 years of which 15 years with a Platinum card. I travel extensively and most times I book with the FHR properties and have been a loyal and outright supporter of the Platinum card with friends and associates.

However, recently I stayed at the Langham Hotel in London a FHR property with my family booking 3 rooms for 5 nights. For some reason the hotel did not charge me the rates that I booked thru AMEX’s FHR program and we’re indicated on my AMEX Trip ID Document.

I disputed the charge thru AMEX and after a month long review AMEX came back siding with the Hotel but offered no explaination of why my rates on the Trip ID were not used.

At one point a representative on the AMEX Support Team stated the rates on the Trip ID were estimates.

I understand the tax line could be an estimate but room rate are not. I am still pursuing this issue and look forward to any advise on how to further proceed.

I want to remain a AMEX cardholder, but this issue is hard to let pass by.

Regards

JPB

That sounds awful. Do you have the booking confirmation? I have never heard of a rate being an estimate. I would dispute the charge again. I have had some where I have had to open disputes 3 times.