Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

In December, Hyatt announced that it was entering into an exclusivity agreement with Playa Hotels & Resorts that would give the hotelier the option of buying the chain of resorts located throughout the Caribbean. Hyatt is dominating the all-inclusive space and it appears that it still has an appetite for more resorts. Now, Hyatt has shared that it is acquiring all outstanding shares of Playa Hotels & Resorts in a deal valued at $2.6 billion.

Hyatt has been on a buying and partnership spree for several years. It announced an exclusive agreement with the Venetian and Palazzo in Las Vegas in December. In November, the Rio become part of the Destination by Hyatt brand. Hyatt signed on to manage the all-inclusive portfolio of Bahia Principe-branded hotels and resorts last October. It also acquired The Standard and Bunkhouse Hotels last August. The list continues with Apple Leisure Group, Mr & Mrs Smith, Two Roads Hospitality, Dream Hotel Group, me and all hotels, and more over the past few years.

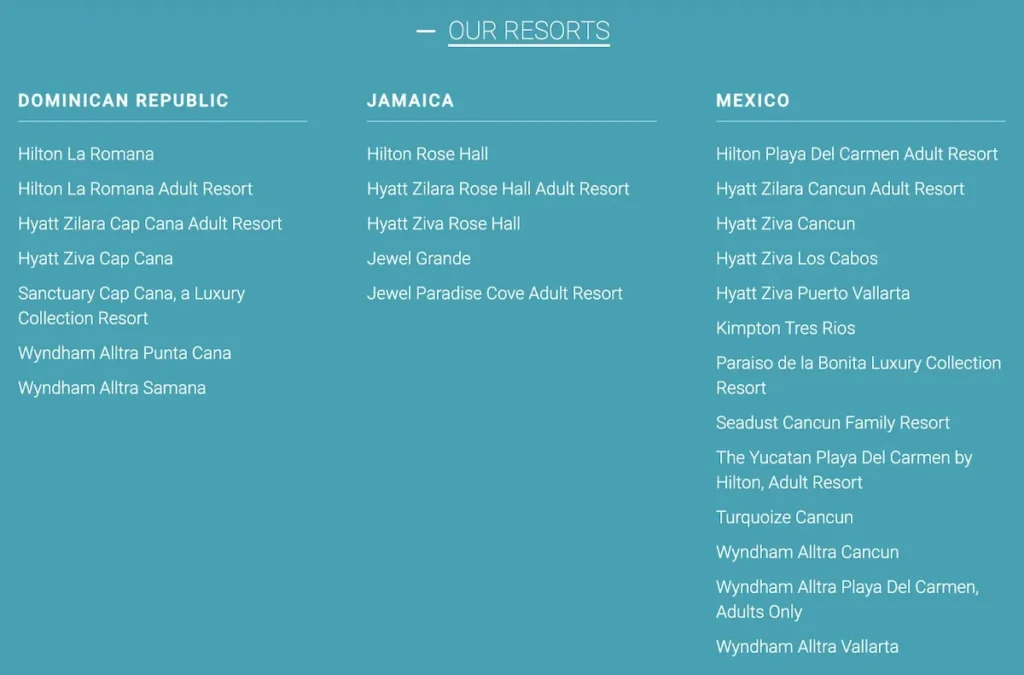

Playa Hotels & Resorts owns 24 resorts in the Dominican Republic, Jamaica, and Mexico. Hyatt already owns 9.99% of the company. These properties are physically owned by the hotel group rather than being asset-light agreements (like most of Hyatt’s portfolio). Brands in the Playa portfolio include everything from Hyatt Ziva and Zilara to Hiltons, Wyndhams, and more. When this deal goes through, a lot of properties will be reflagged. Hyatt will look to divest around $2 billion worth of properties to third parties to keep its asset-light model going.

Mark Hoplamazian, President and Chief Executive Officer at Hyatt, said:

Hyatt has firmly established itself as a leader in the all-inclusive space, a journey that began in 2013 through an investment in Playa Hotels & Resorts that launched the Hyatt Ziva and Hyatt Zilara brands. We have respected and benefitted from Playa’s operating expertise and outstanding guest experience delivery for years through their ownership and management of eight of our Hyatt Ziva and Hyatt Zilara hotels. This pending transaction allows us to broaden our portfolio while providing more value to all of our stakeholders through an expanded management platform for all-inclusive resorts.”

Hyatt has been heavily investing in the all-inclusive space. I am not a fan of all-inclusive resorts, but many like the convenience and simplicity of these vacation factories. Hyatt wants to continue to dominate the space and the easiest way to continue to grow is through acquisition.

Anthony’s Take: I wish Hyatt would focus less energy on all-inclusive resorts and more on adding to the rest of its portfolio. Thankfully, Hyatt is also adding quite a bit to its regular hotel footprint including at brands I love like Andaz, Park Hyatt, etc.

(Image Credits: Hyatt.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.