Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

Earlier today, I wrote about Frontier Group Holdings, Inc. announcing that it was once again attempting to acquire Spirit Airlines. It filed a Form 8-K with its intentions around a proposed merger with the Securities and Exchange Commission only this morning.

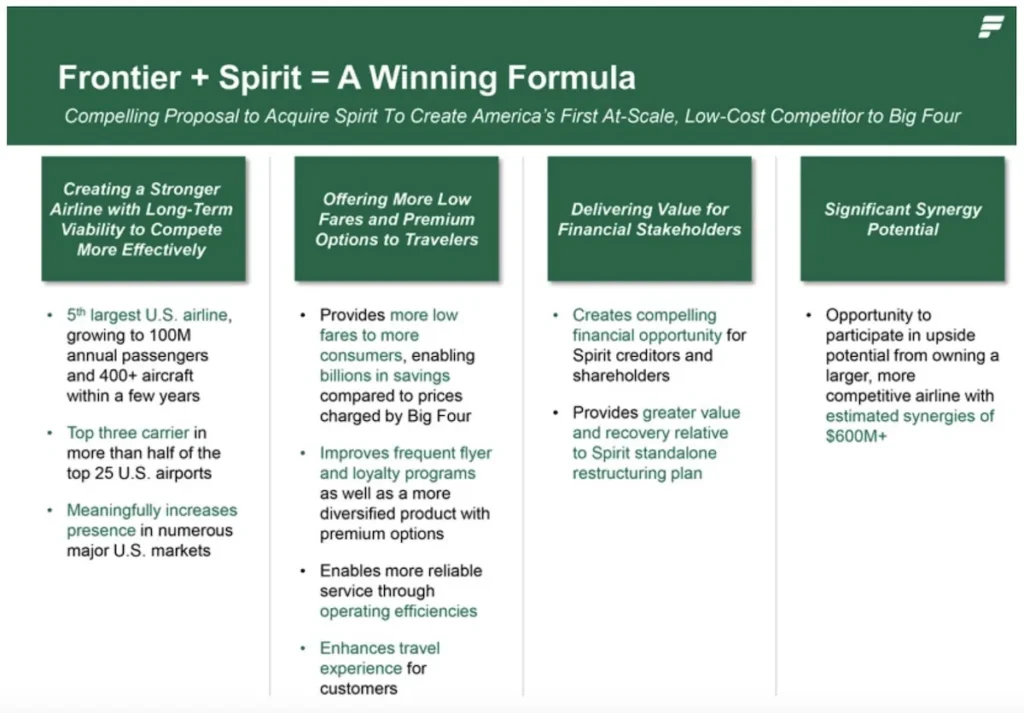

This is not the first time that Frontier has made a move to acquire Spirit. It first announced plans to merge with the airline back in February 2022. The goal was to create a larger, low-cost carrier that could better compete against American, Delta, Southwest, and United. JetBlue countered with a $3.8 billion deal to acquire Spirit. That deal was terminated in March 2024 after the Department of Justice (DOJ) won its case to block the merger in January 2024.

The latest deal would have created the fifth largest airline in the United States. It would have also brought synergies from merging the loyalty programs, which would be boosted by credit card revenue, and cost savings from aligning across airport infrastructure.

Spirit has countered that its creditors would do better if it remained a standalone airline and also highlights that Frontier had offered more to acquire it in the past. It filed its own Form 8-K with the Securities and Exchange Commission stating that Frontier’s offer “represents an extremely material reduction in value.”

A lot has changed since the last merger attempt. Spirit has already filed Chapter 11 bankruptcy in an effort to restructure its debt. It has reassured passengers that their tickets, points, and all other aspects of traveling with the low-cost carrier will remain the same and that employees, vendors, aircraft lessors, and holders of secured aircraft indebtedness will also see business as usual. But, how long can it carry on with business as usual? Spirit can’t logically expect Frontier to pick up exactly where it was before.

Low-cost carriers and Spirit in particular have had a rough time the past few years as full-service airlines thrived and broke all sorts of records. Passengers shifted to want more premium experiences. This coupled with higher labor costs and issues around aircraft delivery have all contributed to the current state. Spirit, Frontier, and JetBlue are pivoting to add premium cabins and amenities, but it’s likely too late for them to make it on their own. Combined, the two would have a better shot as the fifth largest in the United States.

Anthony’s Take: In the end, Spirit is likely going to have to merge or go out of business. I don’t love the idea of Frontier running the combined airline as there is a lot I like about Spirit from a passenger perspective, but it seems like this could be a likely outcome. We’ll see who makes the next volley.

(Image Credits: Frontier Airlines and Spirit Airlines.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.