Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links below. This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.

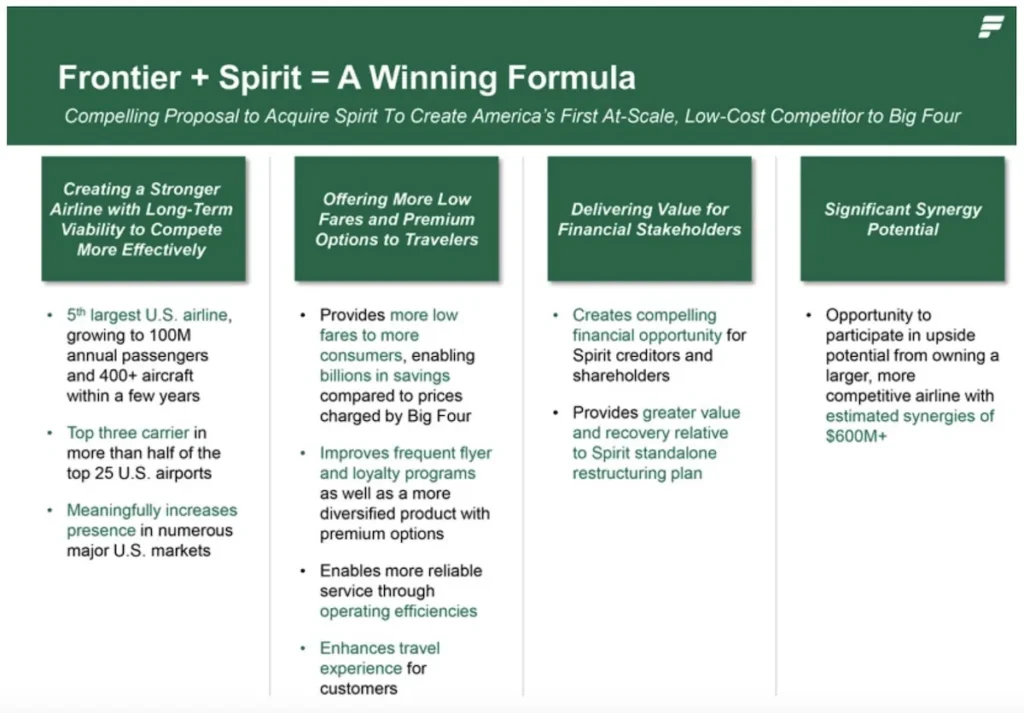

Frontier Group Holdings, Inc. announced today that it is once again attempting to acquire Spirit Airlines. It first announced plans to merge with the airline back in February 2022. The goal was to create a larger, low-cost carrier that could better compete against American, Delta, Southwest, and United. JetBlue countered with a $3.8 billion deal to acquire Spirit. That deal was terminated in March 2024 after the Department of Justice (DOJ) won its case to block the merger in January 2024. Now, Frontier is making another pass at acquiring Spirit and it might succeed this time under a new administration.

Low-cost carriers and Spirit in particular have had a rough time the past few years as full-service airlines thrived and broke all sorts of records. Passengers shifted to want more premium experiences. This coupled with higher labor costs and issues around aircraft delivery have all contributed to the current state. Spirit, Frontier, and JetBlue are pivoting to add premium cabins and amenities, but it still might be too late for them to make it on their own.

Spirit has already filed Chapter 11 bankruptcy in an effort to restructure its debt. It has reassured passengers that their tickets, points, and all other aspects of traveling with the low-cost carrier will remain the same. Employees, vendors, aircraft lessors, and holders of secured aircraft indebtedness will also see business as usual. But, how long can it carry on with business as usual?

Since submitting its latest acquisition proposal, Frontier has spoken with Spirit’s board of directors, management team, and representatives of some of Spirit’s financial stakeholders. According to Frontier, Spirit’s bankruptcy court filings demonstrate that its standalone plan will “likely result in an unprofitable airline with a high debt load and limited likelihood of success.” Frontier would finance the acquisition with the issuance of newly issued Frontier debt and common stock.

Barry Biffle, CEO of Frontier, said:

While we are pleased with the strong results Frontier has been able to deliver through the execution of our business strategy, we have long believed a combination with Spirit would allow us to unlock additional value creation opportunities. As a combined airline, we would be positioned to offer more options and deeper savings, as well as an enhanced travel experience with more reliable service.”

Bill Franke, the Chair of Frontier’s Board of Directors, added:

This proposal reflects a compelling opportunity that will result in more value than Spirit’s standalone plan by creating a stronger low fare airline with the long-term viability to compete more effectively and enter new markets at scale. We stand ready to continue discussions with Spirit and its financial stakeholders and believe that we can promptly reach agreement on a transaction. We are hopeful we can achieve a resolution that delivers significant value for consumers, team members, communities, partners, creditors and shareholders.”

Anthony’s Take: As I said in one of my predictions for the Trump presidency, I think that Frontier will be successful in its efforts this time. The combined entity will have a much better chance competing with the legacy carriers. If this gets struck down again, Spirit’s future is not looking too bright. The merger will make a combined carrier competitive with the legacy US airlines.

(Image Credits: Frontier Airlines and Spirit Airlines.)

User Generated Content Disclosure: The Bulkhead Seat encourages constructive discussions, comments, and questions. Responses are not provided by or commissioned by any bank advertisers. These responses have not been reviewed, approved, or endorsed by the bank advertiser. It is not the responsibility of the bank advertiser to respond to comments.

Advertiser & Editorial Disclosure: The Bulkhead Seat earns an affiliate commission for anyone approved through the links above This compensation may impact how and where links appear on this site. We work to provide the best publicly available offers to our readers. We frequently update them, but this site does not include all available offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities.